Nomi Prins is out with a new presentation called The #1 Stock For America's Great Distortion.

She claims this company can make your money back 10 times over!

Sounds good but there's a problem..

Nomi won't tell you the company name unless you buy her newsletter, The Distortion Report.

Well I have good news!

I was able to figure out the name of the company Nomi is teasing and reveal it below.

You'll also get a ton of information on this stock so you can decide if it's right to invest in.

Let's get started!

#1 Stock For America's Great Distortion Summary

Stock picker: Nomi Prins

Newsletter: The Distortion Report

Link to teaser: Rogueeconomics.com

Stock: Chargepoint (CHPT)

Summary: The company being teased here is Chargepoint.

They are the largest maker of electric car chargers and have deals with Starbucks and other companies to provide them with chargers.

When this presentation went live the stock was at $20 and it dropped as low as $9.. it's recovered since then and is sitting at around $15.

They're not profitable yet and the costs of running Chargepoint are outpacing their revenue.

If you buy this stock your essentially betting on them being able to turn profitable.

My #1 Recommended Stock Picking Service

If you want to maximize returns you need a professionally crafted portfolio of stocks with the stocks I give you. I recommend Capitalist Exploits Insider for anyone looking for a good stock picking service/model portfolio

With this service you get a portfolio of 60 and the goal is 300% returns on all of them.

The folks over at Insider recommend stocks from a dozen different sectors with guidance on how much to invest in each stock.

The price is expensive at $2499 but my readers get a special 40% discount on the service (so you can get it for only $1499).

To learn more, click below:

Figuring Out The #1 Stock For America's Great Distortion

The #1 Stock For America's Great Distortion is a stock presentation created by Nomi Prins.. she's pitching her new investment newsletter called The Distortion Report.

The theme of the presentation is stocks are wildly "distorted" and don't actually reflect their real price.

Some are inflated and others are undervalued.

Nomi paints herself as an expert in finding undervalued stocks that are currently being distorted.

Basically she's a value investor.

In the presentation she claims there's one company in particular that is greatly distorted.

This stock was pretty easy to figure out based on the clues left behind by Nomi.

She references an article where The Motley Fool claims the company could be a potential 10-bagger:

I was able to find this article where they name the company, Chargepoint:

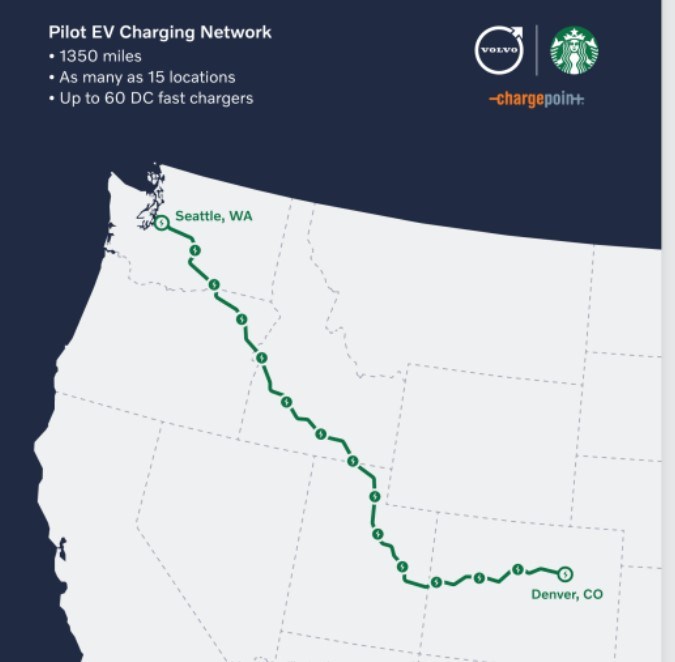

Additionally, Nomi mentions the company she's teasing has a deal with Starbucks to provide chargers.

This article confirms the deal between Chargepoint and Starbucks.

So Chargepoint is 100% Nomi Prin's #1 stock pick for America's great distortion.

Now there's two more stocks she recommends as well.

The first is a mining company called Freeport McMoran. This company mines copper which is used in all electric car batteries.

The second stock is Silveragte Capital.

Silvergate Capital is a fintech company that "provides financial infrastructure solutions and services for the digital currency industry."

Basically they deal with crypto payments and are involved in stable coins.

So now you know the distortion stock picks.. now the question is are they worth investing in?

Is Chargepoint Worst Investing In?

I'm not a financial advisor so I'm not really going to answer this questions directly.

Instead I'm going to leave you with some information about the company so you can decide for yourself.

Let's start off with why this might be a good investment.

Pro #1: Leading The Way

Chargerpoint is the biggest EV charging company in the world and they have more than 200,000 charging locations in the world.

They're continuing to grow and add 2,000 more charging stations per month.

Additinoally, they sell home charging stations.

So they're the biggest in the world and they have enough money to push ahead further.

Pro #2: Deal With Starbucks

This deal is currently in the testing phase but Starbucks is seeing how charging stations work at their stores work.

They're building a bunch of charging stations between Seattle and Denver:

If this proves to be profitable just imagine how many charging stations can be built at Starbucks throughout the country!

Con #1: They're Not Profitable

If you're going to invest in Chargepoint you're investing in the future because right now they're not profitable.

In fact, they're really not close to being profitable and the financials are getting worst.

In 2019 it cost them $1.04 to bring in $0.12. Now it's costing them $1.30 to bring in $0.22.

So their operating costs went up 26 cents but profit only went up 12 cents.

Chargepoint is more a gamble on their ability to figure this out.

Con #2: The Stock Dropped

When this company went public through a SPAC deal last year the stock went to an insane $46.

That was WAY too high.

Since then the price has come back down to earth.

However, Nomi pitched this stock at $20 and it dropped quickly to $9:

This stock just seems like it's having a hard time getting back over that $20 mark.

Analysts are split over what they think the stock will go to as well.

Some think it can get as high as $40+ while others believe it's destined for $12:

Again, this is not a sure thing by any means.

Everyone wants the net big EV stock.. and there's a chance many will pay out HUGE.

However, we're still early in the game and there's time to invest in these stocks.

Waiting to see if Chargepoint profits and deals with these issues might be a good idea.

Want The Best Stock Picks?

Insider is my favorite stock picking service. To learn more about this product, click below:

Who Is Nomi Prins?

I'm torn about Nomi.

In some sense I think she's a good person who does care about people making money.

She wrote an extremely interesting book detailing the collusion between bankers and presidents over the last 100 years.

But her career has been spent at some pretty terrible intuitions.

For example, she used to work for Goldman Sachs and left because of the corruption.

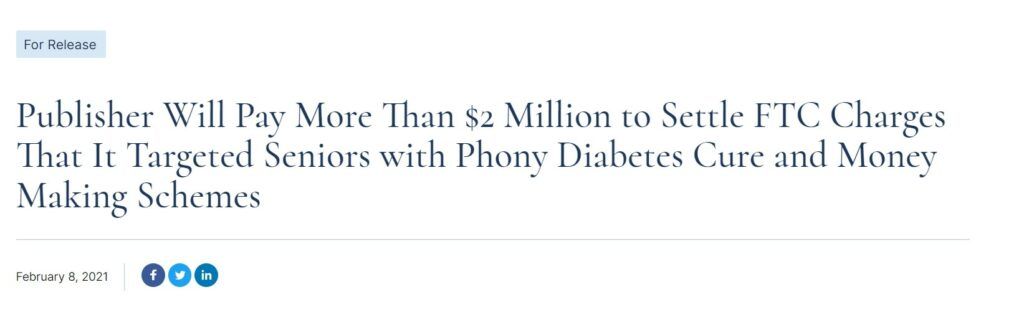

However, her current employer, Agora, is one of the most rotten companies in America.

It's not like she left Wall Street to work for someone that only helps people.

Just to get a taste of how bad Agora is, look at what they were fined just last year for:

Can you take someone seriously who says they left Wall Street because of corruption then works for a company that scams elderly people?

Of course not.

This isn't a one off thing either.

Agora makes so much money that $2 million is nothing to them.

They just continue to target the elderly with deceptive marketing:

At the end of the day you shouldn't "trust" any stock picker.

The only thing that matters is whether the person can pick a good stock or not.

Nomi has struggled with this in the past.

She previously worked for another Agora publisher called Paradigm Press - there Nomi ran a newsletter called 25 Cent trader.

This is was an options newsletter.

However, the newsletter wasn't well reviewed and only got an average score of 2.6/5:

When a newsletter suffers like this Agora will just shuffle the person to a new publisher.

Now Nomi is at Rogue Economics selling The Distortion Report.

Get The Best Stock Portfolio

I've reviewed 100+ stock picking services. My favorite is Insider and my readers get a 40% discount. To take advantage of this, click below:

0 comments