Alexander Green is back with a new stock presentation and this time he's teasing a company he's calling the "King Of LNG."

Green claims it has a chance to go from $30 to $280 and is the result of "Putin's stupidity."

There is one major problem, though - he won't reveal the stock unless you buy his newsletter.

I have good news.. I was able to figure out the name of the stock based on the clues he left behind.

I reveal the stock below along with information on the company so you can determine if it's worth buying.

I also give you an overview of the newsletter Green is ultimately trying to sell you.

Let's get started!

Green's King Of LNG Summary

Stock picker: Alexander Green

Newsletter: Oxford Communique

Link to teaser: Oxfordclub.com

Stock: Flex LNG (ABSI)

Summary: The stock being recommended by Alexander Green is Flex LNG which is a LNG tanker company.

The idea is Putin won't be selling Europe and other countries gas so there's an opportunity for natural gas companies to fill the void.

Flex LNG is a good company but likely isn't going to get any extra business from the gas shortages in Europe.

They already have deals in place for most of their fleet for the next 2 to 10 years.

It's not like they can create more boats out of thin air (they cost $200 million each).

There's a high dividend 10% and should hold steady for the next few years.

The gains Green is promising are likely overstated by quite a bit.

Still worth considering, though.

My #1 Recommended Stock Picking Service

If you want to maximize returns you need a professionally crafted portfolio of stocks with the stocks I give you. I recommend Capitalist Exploits Insider for anyone looking for a good stock picking service/model portfolio

With this service you get a portfolio of 60 and the goal is 300% returns on all of them.

The folks over at Insider recommend stocks from a dozen different sectors with guidance on how much to invest in each stock.

The price is expensive at $2499 but my readers get a special 40% discount on the service (so you can get it for only $1499).

To learn more, click below:

The New King Of LNG Overview

Alexander Green is out with a new teaser proclaiming there's a "new king of LNG."

LNG stands for liquid natural gas so this stock has to do with the natural gas industry.

Let's breakdown the clues in this presentation to determine what company Alexander is talking about.

Winter Is Coming (For Europe)

The stock presentation starts out explaining the current predicament that Europe is facing this winter.

In a stupid move Europe became independent on Russian gas and Putin will not be selling oil to Europe this winter.

As a result there's gas shortages and energy bills are going through the roof:

The situation seems to be getting out of hand as small businesses are getting electric bills that are too much to pay.

At this point Alexander Green begins to explain why this is all a big mistake for Russia and it will create big opportunities for investors.

He has one company in mind that he believes will go from $30 to $280 in the future.

Europe Will Have To Rely On America For Gas

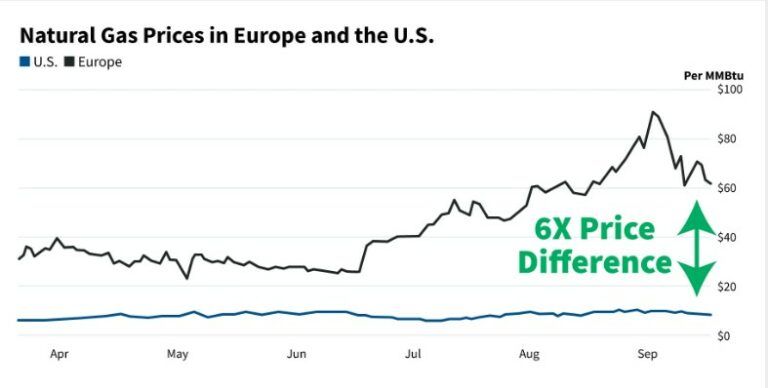

Green continues to explain the trouble Europe is in with their natural gas prices at an all time high.

He shows this chart to show the massive difference in price between Europe gas prices and American:

Alexander claims companies will be using arbitrage to make a profit off of this gas difference.

Arbitrage is when you buy something cheap in one place and sell it for a profit in a place where it's more expensive.

So it sounds to me like Green is hinting at a company that will be able to do this.

Natural Gas Is Hard To Transport From America

America is natural gas rich and we have the technology to get the gas out of the earth.

In fact, we produce the most natural gas in the world.

BUT it's a difficult process getting natural gas from America to Europe.

Natural gas needs to be stored at minus 260 degrees and there's no pipelines from America to Europe.

So it all needs to be shipped by boat.

On top of this much of the natural gas literally evaporates on its journey.

New Technology Makes It Easier

Because of the inefficiencies of transporting gas, tankers would only make around $15,000 per day according to Green.

However, new technology has made this process much easier and more profitable.

Tankers can transport hundreds of millions in natural gas now and they have the technology to keep the gas cool.

Additionally, there's been advancements to prevent the gas from evaporating.

Alexander Green believes there's one company that's going to benefit from this the most.

So now we know the company Green is hinting at will be transporting LNG from America to Europe.

One Company Green Believes Will Capitalize

It's at this point in the presentation Green begins dropping hints about the company.

Here's some clues he leaves:

- Built 13 LNG ships between 2018 to 2021

- Quote from the CEO saying "Europe has been gobbling up LNG spot cargos on an unprecedented level"

- Profit has grown 2400% in their latest earnings

- Has a 10% dividend

- 12 ships are under fixed contracts with LNG prices locked in for up to 10 years

- Profits were $8.1 million in 2020 and now are $202 million

- $284 million cash balance in case of emergency

- A stock price around $30

So this is more than enough information to figure out the stock.

I was able to find the quote of the CEO claiming "Europe has been gobbling up LNG spot cargos on an unprecedented level" in this article.

The CEO is named Oystein Kalleklev and he's the CEO of Flex LNG.

All the other clues match up perfectly with this company as well.

Their stock is around $30, they have a 10% dividend and earnings were $202 million.

Want The Best Stock Picks?

Insider is my favorite stock picking service. To learn more about this product, click below:

Is Flex LNG Worth Investing In?

So now you know that the company Green is pushing is Flex LNG and you've heard Green's very positive spin on the company.

Here's an overview of what I was able to find on Flex LNG so you can decide if it's worth investing in.

Founded 15 Years Ago

Flex LNG was founded 15 years ago and is funded by a man named John Frederiksen who is worth over 11 billion dollars.

The company owns 13 LNG tankers now and 12 of them have long term charter contracts.

They Do Have A Lot Of Debt

One of the big problems in the LNG shipping world is the price to build a new tanker.

The average cost is now around $200 million!

Because most of these ships Flex LNG owns are new they had to spend a lot and take on a lot of debt to get them.

This debt should be manageable for the time being because they have so many long term contracts.

But if LNG ships are in less demand in 5 to 10 years they might have to pay higher rates on their debt which means less profit per vessel.

This won't be a problem for a few years, though.

So you can buy the stock now and sell in a few years before any of this happens.

Don't Expect A Boom From Russia's War

The idea you can make money from the blunders of the dastardly Putin is mostly just a fantasy, though.

Stock pickers like to create these stories to sell the stock picks and it's just meant to keep your attention.

In reality it'll be hard to profit off of the increase in LNG exports for quite some time.

The reason is LNG infrastructure is costly and takes time to build.

The ships used to transport these resources cost hundreds of millions and the export facilities take multiple years to build.

You can't just snap your finger and have more LNG ships and export facilities.

Many of the new deals as the result of the Russian/Ukrainian war won't go into effect until 2026.

So if you're going to invest in Flex LNG do so based on what the company is now and not this war - Flex won't be profiting off it for a long time.

10% Dividend

The company also pays a healthy dividend at 10% that could climb as high as 15%.

John Frederiksen is known to pay out bigger dividends.

As one commentator points out, though, these aren't dividends you want to reinvest back into the stock.

Because of the high debt and the current market LNG stocks might not be buy and hold stocks.

Conclusion

Alright so that's the end of my article of The King LNG stock presentation from Alexander Green.

You now know the stock is Flex LNG and you know why Green likes it so much.

You also got my thoughts on the company and a breakdown of important details about Flex.

In the end the stock is definitely interesting although Green overhypes it.

This is what stock pickers do, however.

You have to research the companies and industries to see the things the stock picker isn't mentioning.

Whether you should invest is up to you now!

Get The Best Stock Portfolio

I've reviewed 100+ stock picking services. My favorite is Insider and my readers get a 40% discount. To take advantage of this, click below:

0 comments