Hey, what's going on?

Today we're going to be revealing a stock teased by Tim Plaehn from The Dividend Hunter.

He claims this investment is his "#1 Buy, Hold, and Retire Tech Stock Of 2022."

Tim goes on to claim this stock allows you to "collect legal backdoor income from pre-IPO Silicon Valley Startups" and that "90% of the earnings are paid to shareholders."

Sounds very interesting!

Read on to see what the stock is, how it's performed and whether or not I trust the opinion of Tim Plaehn.

#1 Tech Stock Summary

Stock picker: Tim Plaehn

Newsletter: The Dividend Hunter

Link to teaser: https://www.investorsalley.com/landing/77309/

Stock: Hercules Capital (HTGC)

Summary: Hercules Capital is a business development company that focuses on lending money to tech start up companies.

Hence why Tim refers to it as a "tech" stock.

Tim has been teasing this stock for over a year now and the stock has dropped from $17 to around $13 since.

It does pay a high dividend of 11% right now.

There's definitely risk here, though.. if the small companies they've been investing in default they'd be in in trouble.

But it is at a pretty affordable price right currently.

My #1 Recommended Stock Picking Service

If you want to maximize returns you need a professionally crafted portfolio of stocks with the stocks I give you. I recommend Capitalist Exploits Insider for anyone looking for a good stock picking service/model portfolio

With this service you get a portfolio of 60 and the goal is 300% returns on all of them.

The folks over at Insider recommend stocks from a dozen different sectors with guidance on how much to invest in each stock.

The price is expensive at $2499 but my readers get a special 40% discount on the service (so you can get it for only $1499).

To learn more, click below:

Figuring Out The Stock

In this section I'm going to show you how I figured out the stock.

The main reason I knew this company is Tim has been teasing it for about a year now and knew it from his previous ads.

Tim starts the presentation off talking about a "little known tech stock that will pay a massive, special dividend the entire year in 2022."

He goes on to call it "one of the the highest yielding stocks on the market."

Tim even says "if he could only recommend one income stock to retire on, this is it."

Tim eventually starts dropping clues about the stock.

The first clue is when he mentions a "forgotten law passed in 1940 that 90% of profits must be paid out to shareholders."

This means he's talking about a Business Development Company (these companies have to pay 90% of earnings to shareholders instead of paying a corporate tax)

BDC's typically focus on small and medium size startups and companies too small to go to Wall Street banks for funding.

Next Tim drops another hint about the stock he's teasing. He claims the company has lent money to an electric bus company that Biden visited in April.

I was able to find an article that names this company - it's Proterra:

Additionally, Tim claims his secret tech stocks has funded Impossible Foods as well and manages $2 billion in capital.

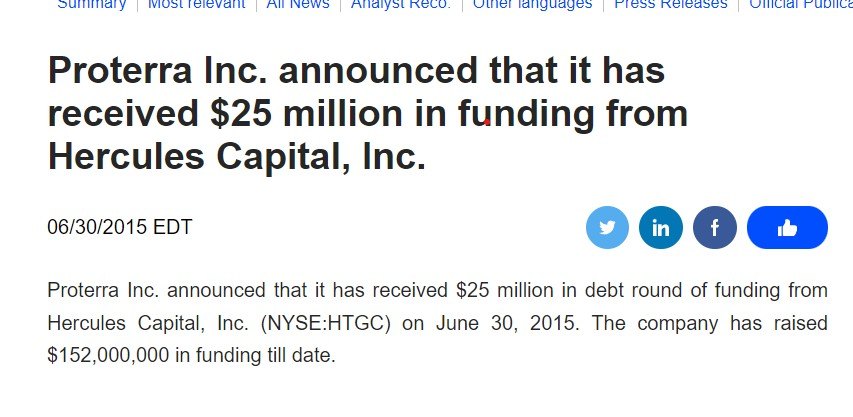

So I did a little digging and found that Hercules has given Proterra $25 million in funding:

In another article you can see Hercules Capital also invested in Impossible Foods.

All the clues are pointing to Hercules Capital being the stock Tim is teasing.

The question now is Hercules Capital worth investing in?

We'll answer that in the next section.

What To Know About Hercules Capital

I'm not a financial advisor so I'm not going to tell you directly whether you should be investing in this company or not.

That's for you to decide.

Here's some information about this stock so you can help make this decision yourself.

Very High Yield

The reason Hercules Capital is a good stock to hold for retirement is because it pays a high dividend.

When Tim first started pitching this stock the dividend was around 9% and it's gone up to around 11% since then.

If you're planning for retirement you simply reinvest the dividend payments back into the stock and increase your pay out over time.

Eventually the goal should be to build a passive income stream from stocks like this to retire one.

That's why Tim calls it a retirement stock.

Stock Price Is Down

Tim has been pitching this stock for a while now and the stock price has steadily been dropping over time.

A big reason for this is they invest in a lot smaller tech start ups and tech stocks have taken a beaten lately.

The red line below shows when I first saw Tim recommending this stock.

So this is a bad thing for people who bought in January and a good thing for you - the stock is at a discount compared to what it was.

Some people still believe it's too high to invest in, though.

Many investors are waiting for it to come down to $11 or $10 before putting money in.

Risky Investments?

This stock is not without its downsides.

The portfolio of companies Hercules Capital has invested in might be a little risky in times like this.

Many of the tech companies they've funded need to grow to be profitable.

Now is definitely not the best time for growth companies and this is why tech stocks across the board are down so much.

Additionally, Hercules Capital has been diversifying their portfolio into biotech companies.

These are companies that merge technology and health.

I've been covering a lot of these biotech stocks lately and many aren't doing well.

A lot of these companies end up going under and I personally wouldn't want to invest in them.

Want The Best Stock Picks?

Insider is my favorite stock picking service. To learn more about this product, click below:

FAQ's About Tim And The Dividend Hunter

The last part of this post will look at Tim Plaehn and The Dividend Hunter.

Here's answers to some common questions about these two:

1) Who Is Tim Plaehn?

Tim Plaehn is the creator of The Dividend Hunter.

Tim flew airplanes for the Airforce and was a F-16 Fighter Pilot instructor.

So you know he's a disciplined guy.

Tim spent time as a truck company salesman and a stock broker.

Eventually he started selling stock picks to retail investors.

Overall Tim seems like a trustworthy guy - more so than a lot of people who sell investing newsletters.

2) What Is The Dividend Hunter?

The Dividend Hunter is ultimately the newsletter Tim is trying to sell you with this presentation.

He withholds the stock hoping you buy the newsletter to learn it.

Now you don't have to buy for that reason because you know the stock being teased is Hercules Capital.

You can decide if you want to buy The Dividend Hunter without that pressure now.

I personally like The Dividend Hunter.

I don't recommend a lot of investing newsletters but this one can definitely be worth buying.

Like the name suggests it'll be looking for high yield, dividend paying stocks.

These are excellent investments because they can lead to full time passive income.

The newsletter works like most and you get the following:

- Monthly newsletter with new stock picks

- Model portfolio

- Alerts

- Special reports

Additionally, you get a tool that helps you map out your dividend payments.

It's only $49 for the first year which is an excellent deal.

3) Does The Dividend Hunter Get Good Reviews?

Yes.

The best place to check customer reviews for investing newsletters is Stock Gumshoe.

Nearly 500 people have voted on this newsletter at Stock Gumshoe and it has a rating of 4/5:

This is a very high score for an investing newsletter and shows people are making money following the recommendations.

4) Is There A Refund Policy?

Yes, there's a very good refund policy.

You get 365 days to get your money back which is about as good as you can ask for.

Conclusion

Alright so that's the end of this post - I hope all your questions have been answered.

You now know the stock Tim is teasing is Hercules Capital and you have some information on whether it's a good stock to invest in.

There's things to like about the stock.. it's cheaper than it was a year ago and they pay a high dividend.

Also, it's performed as well as the S&P 500 the last decade.

On the downside a lot of their company portfolio might be risky in the current economic situation we're in.

Additionally, you have some information on Tim and The Dividend Hunter.

I like Tim and The Dividend Hunter.

So if you're thinking about buying it I say go for it!

Get The Best Stock Portfolio

I've reviewed 100+ stock picking services. My favorite is Insider and my readers get a 40% discount. To take advantage of this, click below:

0 comments